RNA - According to BMI Research, the opening of Iran’s market might provide some relief to the less-supportive economic environment in those countries which are running into stormy headwinds for some time.

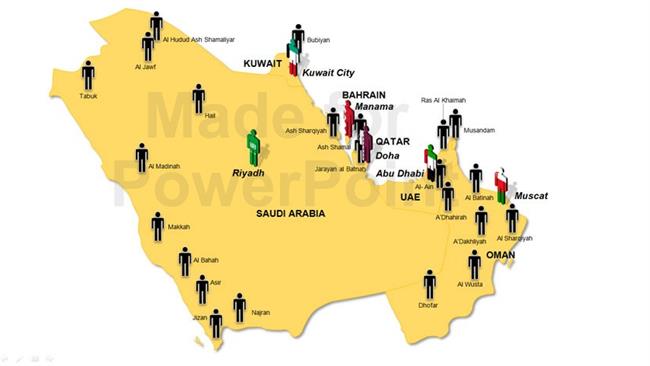

A toxic combination of lower oil prices, reduction in capital expenditure and increased drawdowns in government deposits is squeezing liquidity in the Persian Gulf Cooperation Council (GCC) countries.

This situation is expected to further deteriorate during 2017, impacting vital economic drivers including asset quality, with GCC banks expected to see their performance markedly stunted.

Aggregate credit is to expand by only 5.5 percent this year, which is significantly below the average 11.4 percent recorded between 2011 and 2015, the BMI Research said.

The slowdown is likely to be sustained over the coming five years, BMI warned, putting the situation down to Persian Gulf sovereigns’ shift in position from being “net creditors to net debtors”.

Costly wars and confrontations

According to the study, GCC states are likely to continue facing declines in fiscal revenues over this period. Saudi Arabia and the UAE are the most vulnerable, with government deposits in each country falling by 17 percent and 8.5 percent since the start of 2015.

Saudi Arabia has been waging a costly war in Yemen for the past two years, burning through its foreign reserves at an alarming pace in the face of the oil price decline and a sharp rise in military spending. The price tag for the military adventure is put between $12 billion to $15 billion per month.

The UAE is a key contributor to the military intervention with troops, arms and logistical support.

Standard & Poor’s expects the downward trend to last for at least two years. Over the past year, S&P has taken several negative rating actions on banks in the GCC, mostly in Bahrain, Oman, and Saudi Arabia.

“We think that contractors, subcontractors, small and mid-size enterprises, and highly leveraged retail clients will drive the deterioration of asset quality, as the drop in economic prospects has a negative bearing on project pipelines, government subsidies, salaries, and job markets,” Suha Urgan, an analyst at S&P, told Reuters on Sunday.

According to Olivier Panis, a vice president at Moody’s, certain sectors, particularly contracting, construction, real estate, retail and small and medium enterprises will be more affected.

Iran factor

BMI says Iran holds a flicker of hope for the GCC countries.

Among the GCC states, the UAE was the fourth biggest trade partner of Iran before US-led sanctions began to bite in 2011. That year, the United Arab Emirates set the record $23 billion in trade with Iran.

With the lifting of sanctions last year, trade between the two countries began to take off but tensions between Iran and Saudi Arabia brought it to a sudden halt as the UAE fell in line with the kingdom in scaling down relations with Tehran.

Persian Gulf states, however, have recently indicated a propensity to mend fences with Iran. Last week, Kuwaiti Foreign Minister Sheikh Sabah al-Khalid al-Hamad Al Sabah traveled to Tehran with a message from GCC countries.

Kuwait’s al-Rai newspaper wrote after the visit that a senior official of the country has voiced optimism over the prospects of better relations between Iran and the Persian Gulf Arab states.

847/940